Taking lump sums

You can leave your money in your pension pot and take lump sums from it as and when you need, until your money runs out or you choose another option.

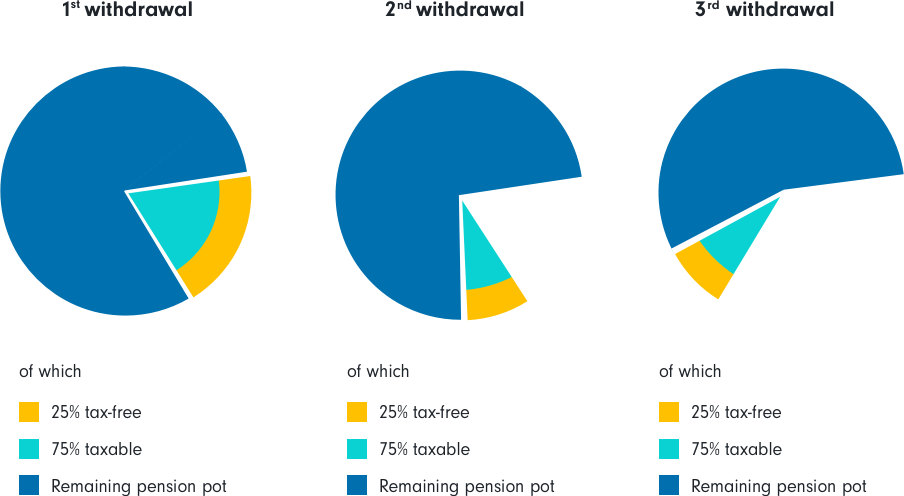

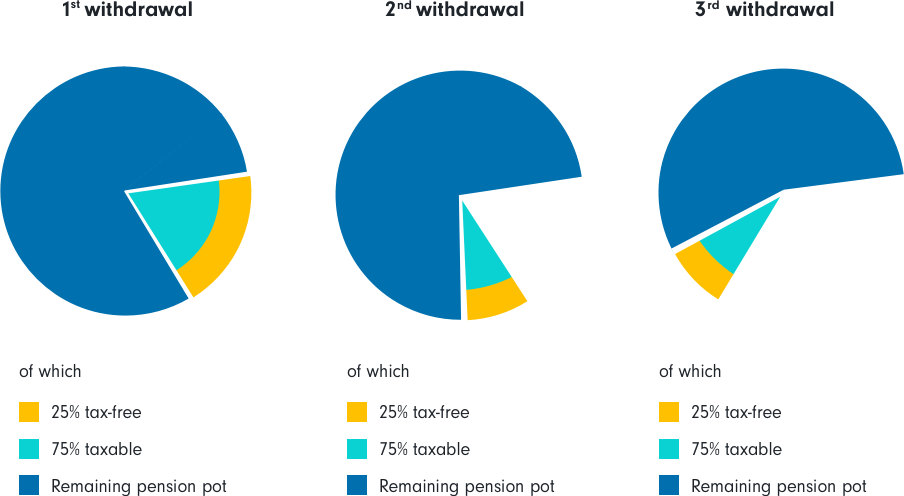

In some cases, the best way to take money out of your pension is to withdraw a series of lump sums over time, instead of taking all the tax-free cash in one go. When you do this, 25% of what you withdraw is free of tax while the other 75% is taxed like any other income you earn. This way, you can make multiple withdrawals.

When you do this, it’s called taking an Uncrystallised Funds Pension Lump Sum (UFPLS for short).

Things to consider

Taking your pension pot as one lump sum (uncrystallised funds pension lump sum or UFPLS) is the easiest way to go about this. This is potentially a high-risk strategy as your pension savings were designed to provide for you throughout retirement. You could also have a high income Tax bill to pay.

Taking your pension pot as a number of lump sums can help here because it allows you to take your tax-free cash in stages. If you’re a basic-rate taxpayer, you could withdraw an amount each year that keeps you under the higher tax rate threshold. This could then leave you with a higher income from a lower total payment.

Scenario one: On her 60th birthday, Sarah takes £15,000 from her pension pot. Only £3,750 (25%) of this withdrawal will be tax-free. The other £11,250 (75%) will be added to her earnings for that year. This makes Sarah a higher-rate tax payer on half the money so she pays tax at 20% on half and tax at 40% tax on the other half (about £3,375 in total).

Scenario two: On her 60th birthday, Sarah takes £7,500 from her pension pot and, a year later, the same amount again. Each year, 25% of Sarah’s withdrawal (£1,875) is tax-free and 75% (£5,625) is added to her earnings. As a result, she remains a basic-rate taxpayer in both years and could save herself as much as £1,125 in tax.

The above examples are based on UK tax rates. Tax rates for Scottish Residents differ from the rest of the UK.

Budget for retirement

Calculate tax on withdrawals

Pension Wise

Taking lump sums will affect your future contributions

If you think you might want to top up your pension pot in the future, for instance because you want to keep working part time, then you need to be aware that taking money out in lump sums could affect the amount you can pay in and receive tax relief on.

If you take money out in this way, you may only be able to receive tax relief on up to £10,000 a year. If you exceed this figure, you may need to pay tax to HMRC. This is known as the money purchase annual allowance (MPAA).

If you think you’ll want to continue topping up your money purchase pension pot with more than £10,000 a year after you retire, then you may want to consider other options.

Find out more about the money purchase annual allowance and how it could affect you in our guide.

The value of investments can go down as well as up, so you may get back less than you invest. Tax treatment and eligibility to invest in a pension depend on personal circumstances. All tax rules may change in future. The minimum age you can normally access your pension savings is currently 55, and is due to rise to 57 on 6 April 2028, unless you have a lower protected pension age.

This information is not a personal recommendation for any particular product, service or course of action. Pension and retirement planning can be complex, so if you are unsure about the suitability of a pension investment, retirement service or any action you need to take, please refer to an authorised financial adviser.